Кремация домашних животных представляет собой ответственный и уважительный способ провести последнее прощание с любимым

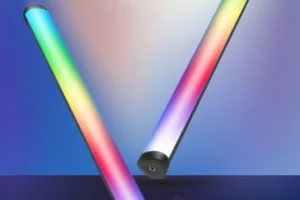

В современном мире, где каждый стремится к энергоэффективности и долговечности, светодиодные трубки представляют собой

Ремонт в квартире, где предстоит жить вместе с домашними животными, требует особого внимания к

Футболки с изображениями хаски стали особым трендом среди любителей собак, особенно тех, кто восхищается

Продвижение в социальных сетях, в частности в ВКонтакте, может быть как эффективным, так и

При переходе на натуральное питание важно учитывать индивидуальные потребности собаки, включая ее возраст, породу,

Пионовидные розы – это уникальный и восхитительный вид роз, который сочетает в себе изящество

Кастрация и стерилизация домашних животных – это ответственные процедуры, которые помогают предотвратить ряд заболеваний

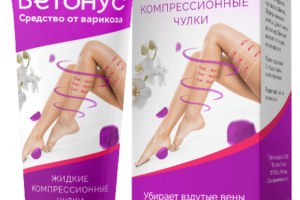

Ветонус представляет собой инновационный гель от варикоза, который помогает облегчить симптомы и улучшить состояние

Купить живых бабочек для наблюдения за их удивительным жизненным циклом может быть замечательным способом

Горячая пицца - это одно из самых популярных блюд в мире. Она сочетает в

Недорогие новогодние сладкие подарки для детей станут настоящим сюрпризом на зимние праздники. Разнообразные наборы

В данной статье мы более подробно рассмотрим особенности породы Акита-ину и подчеркнем, почему они

В мире, где технологии развиваются стремительными темпами, образование не может оставаться в стороне.

При выполнении строительных, ремонтных или грузоперевозочных работ часто возникает необходимость в использовании специализированной техники.

Ветеринарный кардиолог - это специалист, который специализируется на диагностике, лечении и уходе за сердечно-сосудистой

Корги - это порода собак, которая происходит из Уэльса. Они известны своими короткими ножками,

Стерилизация кошек является эффективным и безопасным способом контроля популяции кошек и поддержания их здоровья.

Благотворительные фонды помощи животным играют важную роль в защите и поддержке животных, которые нуждаются

Покупая щенка, помните, что вы покупаете не игрушку, а живое существо, которое нуждается в

Этот канат широко используется в различных областях благодаря своей прочности, гибкости и устойчивости к

Производство натурального корма для собак Pet Bistro в России представляет собой компанию, которая специализируется на

Ветеринарная клиника - это учреждение, где предоставляются медицинские услуги для домашних животных.

Покупка искусственных цветов через интернет-магазин предлагает ряд преимуществ:

Организация, с другой стороны, представляет собой формальную структуру или сущность, созданную для достижения определенных

Xrustalik.ru является интернет-магазином, который занимается продажей посуды из стекла, в том числе товаров от

Жетон для собаки может быть выполнен из различных материалов, таких как металл, пластик, керамика

Ветеринарная служба "МосВетЦентр" - это ветеринарный клиник, которая предоставляет предлагает услуги по эвтаназии и

При выборе мясных консервов необходимо учитывать индивидуальные нужды собаки, такие как возраст, размер, активность

Хорошее качество корма, состоящее из белков, жиров, углеводов, витаминов и минералов, поможет обеспечить достаточное